IAC Inc. Common Stock, News & History

IAC (InterActiveCorp) is a diversified internet and media company based in New York City. Founded in 1995 by Barry Diller, IAC has grown significantly over the years, owning a portfolio of companies that span various sectors, including online dating (Match Group), home services (Angie’s List), and video streaming (Vimeo). While IAC’s focus has traditionally been on growth and reinvestment, understanding its dividend history provides insight into its financial health and strategic direction.

Historical Background of IAC’s First Dividend Payments: As part of a larger plan to give shareholders their money back, IAC started paying dividends in the early 2000s. The company’s cash flow creation and the necessity to give investors a return in the face of a fast evolving digital landscape were factors in the decision to start paying dividends.

Key Points:

Common Stock: IAC’s common stock, denoted by the ticker symbol IAC, is traded on the NASDAQ. Shares are available for purchase and sale, and the performance of the stock can provide information about the company’s overall financial standing and competitive position.

Recent News: As of 2024, IAC has been involved in a number of business developments, such as financial reporting, acquisitions, and strategic changes to its brand portfolio. To comprehend its market performance, one must monitor press releases and financial reports.

History: Since its founding in the late 1990s, IAC has undergone a great deal of innovation and change, growing into a major force in the media and internet industries. The introduction and sale of well-known platforms like Match Group (which includes Tinder) and the ongoing expansion of its media properties are important turning points.

1. Is IAC a good investment?

A portfolio of digital brands and companies is owned by the diversified holding firm IAC (Interactive Corporation).

It has a proven track record of generating value for shareholders, as seen by its successful spin-offs and investments.

Advantages:

- Robust Portfolio: IAC owns a wide variety of companies in a number of sectors, including as media, home services, online dating, and more. Stable growth and risk mitigation are two benefits of this diversity.

- Proven Management Team: IAC boasts a knowledgeable and accomplished management team that has a track record of spotting and growing profitable companies.

- Innovation Focus: The business has a track record of making investments in cutting-edge businesses and technology, setting itself up for future expansion.

- Spin-Off Strategy: Over the years, IAC has produced substantial wealth for shareholders by dividing its profitable operations into separate entities.

IAC Stock Price: A Closer Look

Comprehending the Business Model of IAC

The core of IAC’s business strategy is the acquisition, development, and management of digital companies. The business has a proven track record of generating value for shareholders, as evidenced by its successful spin-offs and investments. Among its noteworthy assets are Vimeo (a platform for sharing videos), Angi (a marketplace for home services), and Match Group (owner of Tinder, Match.com, and other dating applications).

Factors Influencing the Stock Price of IAC

1. Core Business Performance:

- Match Group: One of IAC’s biggest investments, Match Group’s performance has a big impact on IAC’s stock price, especially when it comes to subscriber growth and revenue.

- Angi: Another important factor in the success of Angi’s home services marketplace is its capacity to draw both clients and service providers.

- Vimeo: IAC’s stock price may be impacted by the expansion of Vimeo’s video-sharing business and its capacity to rival other platforms like YouTube.

2. Economic conditions and market sentiment:

- The valuation of IAC’s shares may be impacted by general market factors, such as investor mood and economic indicators.

- Lower stock prices and a decline in investor confidence might result from economic downturns or uncertain times.

Conclusion :

Online dating, home services, and educational technology are just a few of the industries that IAC Inc., a diversified media and internet firm, is well-known for its portfolio of brands and services. Through partnerships, acquisitions, and investments in developing digital markets, IAC has proven over the years that it takes a strategic approach to growth. The company is now in a position to concentrate on its core business and increase shareholder value thanks to recent developments including the spin-off of some subsidiaries and initiatives to streamline its business model.

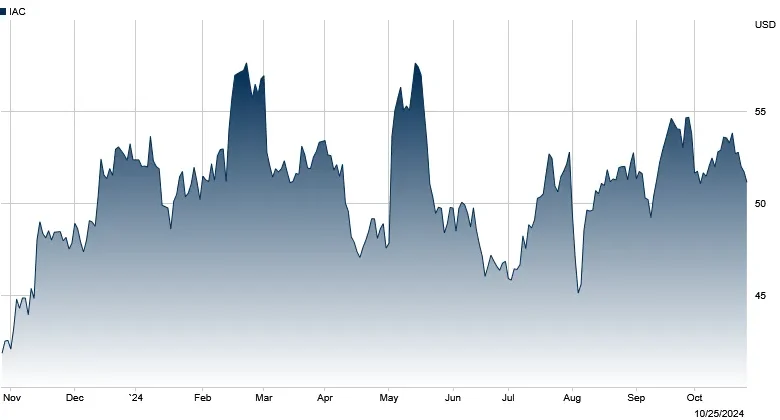

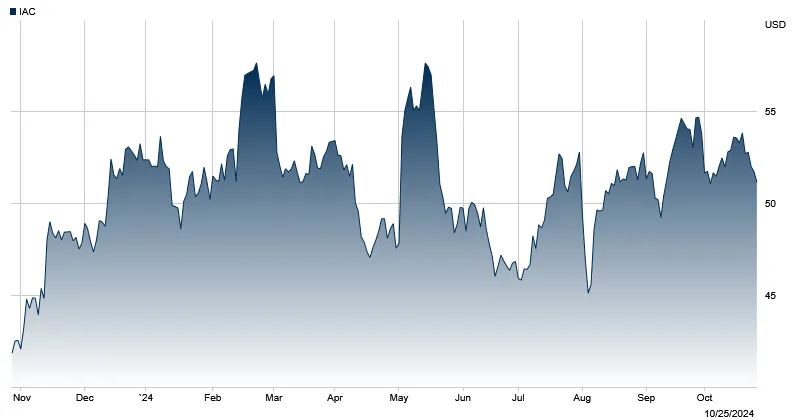

The company’s ability to adjust and respond to market trends is reflected in the performance of its stock, which frequently fluctuates in response to news about its subsidiaries, quarterly earnings reports, and changes in the industry at large. IAC’s announcements on mergers, acquisitions, and the introduction of new products are widely watched by investors since they have a big influence on the company’s stock price and how the market views it.

FAQs:

1. What is IAC?

IAC is a diversified holding company that owns and operates a range of digital businesses. It has a history of acquiring, building, and spinning off successful companies.

2. How has IAC’s stock performed historically?

IAC’s stock performance has varied over the years, influenced by factors such as the performance of its underlying businesses, market trends, and economic conditions. It’s recommended to analyze historical data and consult with a financial advisor for a comprehensive understanding.

3. What are the key factors that influence IAC’s stock price?

Factors such as the performance of its core businesses, market sentiment, economic conditions, company strategy, industry trends, and competition can all impact IAC’s stock price.

4. What are some of IAC’s major holdings?

Some of IAC’s notable holdings include Match Group (owner of Tinder, Match.com, and other dating apps), Angi (a home services marketplace), and Vimeo (a video-sharing platform).